Have you ever been to the race track to watch the horses run? You might experience a surge of adrenalin, an almost palpable sense of anticipation as - their jockeys in taut readiness - the horses bunch preparing to break. As the gates open, the mounts bolt to the fore. You wouldn't be human if a sensation like lightning didn't radiate down your spine as you witnessed this equine bolt. I've watched the Kentucky Derby on television, and as the thunder of hooves pummeling the turf rounded the course, my own legs were flexing with their every stride.

The Kentucky Derby is 1 1/4 miles in distance. It's held at Churchill Downs, in Lexington, Kentucky. It's the first of the Triple Crown races, held from May through early June. It's followed by the Preakness Stakes, a race of 1 3/16 miles, held at Pimlico Race Course in Baltimore, Maryland. The final gem in the crown is the Belmont Stakes, 1 1/2 miles in length, held at Belmont Park in Elmont, New York. A horse that wins all three races in one year has mounted the utmost pinnacle of thoroughbred horse racing in the United States, and is considered a Champion without rival.

Winning the Triple Crown is such a rare achievement that it has been accomplished only eleven times in history, and not since 1978. Only the most indefatigable steed - fleet without equal - can hope to cross the finish line first in all three races. And only a premier jockey would mount such a beast, presuming to be a contender for the crown. It requires the commingling of the strength of the horse and the skill of the rider to vanquish their foes. To succeed, they must develop a symbiosis, virtually becoming almost as one, as if through some marvelous transmogrification they had transformed into a centaur.

If a razor-thin, rodent-faced, grotesque gnarled gnome of apparent Middle Eastern heritage - cheeks pockmarked with more acne scars than the moon has craters, smoking a stogie and belching more fumes than a Chinese coal factory smokestack - had walked up to you in 1973 and snapped you on the forehead with a rolled up Daily Racing Form and then leaned in to confide sotto voce "Fast Eddie is bettin' on Secretariat to win the Derby," would you have listened? What if he was dressed like Aladdin's djinni of Arabian Nights fame?

What if he was wearing a bejeweled carmine turban, embroidered gold lame vest, billowy silk parachute pants, and pointy-toed slippers with curling tips? And he informed you in his seemingly incongruous nasal Jersey accent "someone rubbed me the wrong way this morning," as he glanced around furtively,"and youse is the first guy I saw, so's I gotta grant ya tree wishes. See, I'm a Genie." If you saw him again in 1977 and he told you, "Seattle Slew, bet it all," and followed this advice with "Affirmed, I ain't gonna tell ya agin," in 1978, would you pay attention?

If you knew - before the race had begun - which horse was going to win, would that influence your wager? You wouldn't need to rely on instinct - to place what would turn out to be a losing bet - for Alydar to win at Churchill Downs in 1978. Let's depart from these musings for a moment to indulge in metaphor. The race for the finish line could be likened to the various elements of metals commodities all vying for the greastest percentage gains. Which horse will win? Will it be Barbarous Relic? One Shining Moment? Or Big Red? Gold, silver, or copper?

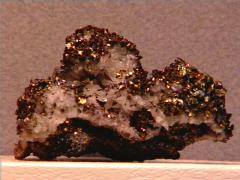

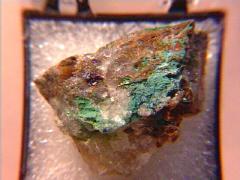

Is it even fair to include copper in the conversation if you're talking about bullion? After all, it's not a precious metal. Isn't it a base metal? Its main uses are industrial, not a store of wealth. Why would you expect it to increase in value under the effect of the same stimuli that are giving impetus to price appreciation in silver and gold? Will the same leather crop applied to the flank work to spur different horses? What is causing them to run at their present speed, and which might win the race? All will do well, but in which order might they win, place, or show?

The fiscal policies of our government, aided by the loose monetary practices of the FED, have resulted in the creation of a massive amount of new money. As a consequence of TARP, but extending further than that futile attempt to rescue banks whose balance sheets were bloated with toxic subprime mortgages, the money supply doubled. This took place in a little more than four months. Price inflation generally lags money creation by eighteen to twenty-four months, but commodities - goaded by this catalyst - are sure to soar.

It's no different than if a contingent of Emirate sheiks crowded to the front of the pari-mutuel betting queue to place colossal wagers on their favorite Arabians. The effect of such a sudden injection of funds of this magnitude - expanding a circumscribed reservoir of money - would cause an incalculable impact. At the time of the influx, we would be unable to ascertain what ripple effects would eventually result. The recently infused wave of liquidity is sure to have ramifications we can't yet comprehend. Let me offer an idea of what those repercussions might be like.

You're going to witness an exponential increase in the price of everything. Prices for food, gasoline, medical expenses, insurance, and utilities are going to quickly become unaffordable; particularly injurious to those on fixed income. You're going to have to purchase precious or base metals commodities to preserve your purchasing power. If you can determine which commodity has the best odds of increasing in price as the inflationary tsunami approaches land, you stand to not only survive, but to thrive. Investors who - in recognition of this likelihood - took early action, have contributed to the unheralded precious metals bull market that began in 2002.

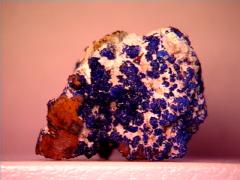

Silver and gold have both demonstrated laudable gains affording greater profits than like investments in stocks or bonds would have realized during the same time frame. They've both emerged to recent acclaim; one can no longer characterize their advance as stealthy. Gold captures the spotlight; it wasn't that long ago that the evening news was replete with new highs that it approached or breached. Often for several days in a row. Silver lags, but has the potential to surpass Gold's percentage increase by multiples. Yet, there have been periods when both of these "safe haven" metals were outperformed by copper.

"Sure," you'll say, "any given commodity might outperform others at any particular time." This is true, and the following example is illustrative. Within any given window of reference, performance is dependent on a number of variables. Copper underwent a deeper retrenchment than silver or gold, thus just getting back to par with its levels of early 2008 makes it seem all the more impressive. If you wait to buy on these deep pullbacks - that aren't justified by fundamentals - each metal will give you frequent entry points that can prove profitable. But you'll have to overcome your reluctance to "try and catch the falling knife."

Copper is like an unappreciated maiden attempting to compete with known winners. After the global scare of October 2008, metals commodities were reigned in hard, some halted in their tracks. Although they rebounded as a recovery of sorts took place, they took another hard stumble in the mud in February 2009. Since their lows of that month, Big Red has been breezing in morning workouts and racing handily. One Shining Moment and Barbarous Relic are still on lead from their grooms, circling in their paddock, slowly warming up to overcome stiffness.

There is such volatility in the precious metals market, it's almost like weighing kiwis and cantaloupes to attempt to compare copper with silver and gold. Yet from that low of February 9, 2009 gold has climbed from approximately $888 an ounce to $1104, for a gain of 24.3%. Silver has progressed from $13.00 to $17.50 an ounce for an advance of 34.6%. Copper outperformed both, climbing from about $1.40 to $3.21 a pound. That was an incredible 129% leap, reminiscent of Secretariat's 31 length going away win at the Belmont in '73. Sometimes it doesn't matter where you are in the pack, but rather how swiftly your horse is pacing at the moment.

Finally, a strategem that is sometimes given short shrift is relative volatility. Pay heed to Ted Butler and you'll awaken to the fact that there's massive naked short selling in silver futures on COMEX, by Goldman Sachs and JPMorgan. Bill Murphy of GATA, along with John Embry of Sprott Asset Management Group claim to have incontrovertible evidence demonstrating their allegation that gold prices systematically suffer severe suppression. They claim that various Central Banks, colluding with our own vaunted Plunge Protection Team, periodically conspire to smother the gold market by a combination of pervasive gold leasing compounded by profuse short selling.

Copper's primary utilization is by industry. It doesn't wield the significant repute of a monetary fortress with long-acknowledged prowess for defending purchasing power. Most analysts fail to consider it a harbinger of inflation if its price rises moderately, thus its increase in value is not viewed as a bellweather of dire depreciating dollar dysfunction. Base copper seemingly escapes the machinations that its noble cousins suffer, and therefore manifests a relatively stable mood. Gold and silver are like bipolar patients in One Flew Over the Cuckoo's Nest, who refuse to take the lithium dispensed by Nurse Ratched. Roaming the halls, free of pharmacological restraints, they are subject to either glee or despair, correlating to their highs and lows.

The point of this piece, then, is you don't really need to scurry around the grandstands trying to handicap the horses, attempting to predict which may prove the favorite. You aren't gambling - endeavoring to win the Trifecta - by picking the exact order of the top three finishers in correct sequence. They're all winners; proven Champions. It doesn't matter if one steed is galloping, while another is cantering or trotting. A third may even be motionless, temporarily hobbled by a painful hoof spur. It doesn't make any difference. Bet the whole program; all three will do well. Call it real money physical metals asset allocation. It's a bet you're sure to win.

Buy Silver. Buy Gold. Save Copper. Start Now.

Friday, December 25, 2009

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment